- The NFT market is heating up and investors are looking to cash in.

- Shares of Takung Art, Oriental Culture, Dolphin Entertainment, and more have soared amid NFT euphoria.

- The rising share prices come despite worrying financials for the once downtrodden firms.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

NFT-related stocks have been on fire over the past few weeks as investors seek exposure to the red-hot digital art market.

Shares of Takung Art, a Chinese digital art marketplace, have soared over 950% in the past two weeks alone.

The company now boasts a market cap of well over $700 million despite posting revenue of just $3.5 million and a net loss of nearly $1 million for the nine months that ended in September 2020, according to SEC filings.

Takung Art isn't alone. Oriental Culture, an online provider of collectibles and artwork, saw its shares jump roughly 235% since the NFT craze began earlier this month.

Even non-NFT related companies are looking to enter the market.

Dolphin Entertainment stock more than doubled on Tuesday after the firm announced a new business division dedicated to "designing, producing, releasing and promoting NFTs for itself and its clients."

Trading volume for the firm ballooned to over 13 million on the day. Dolphin Entertainment posted a net loss of over $1 million for the nine months that ended in September 2020, according to the company's latest SEC filings.

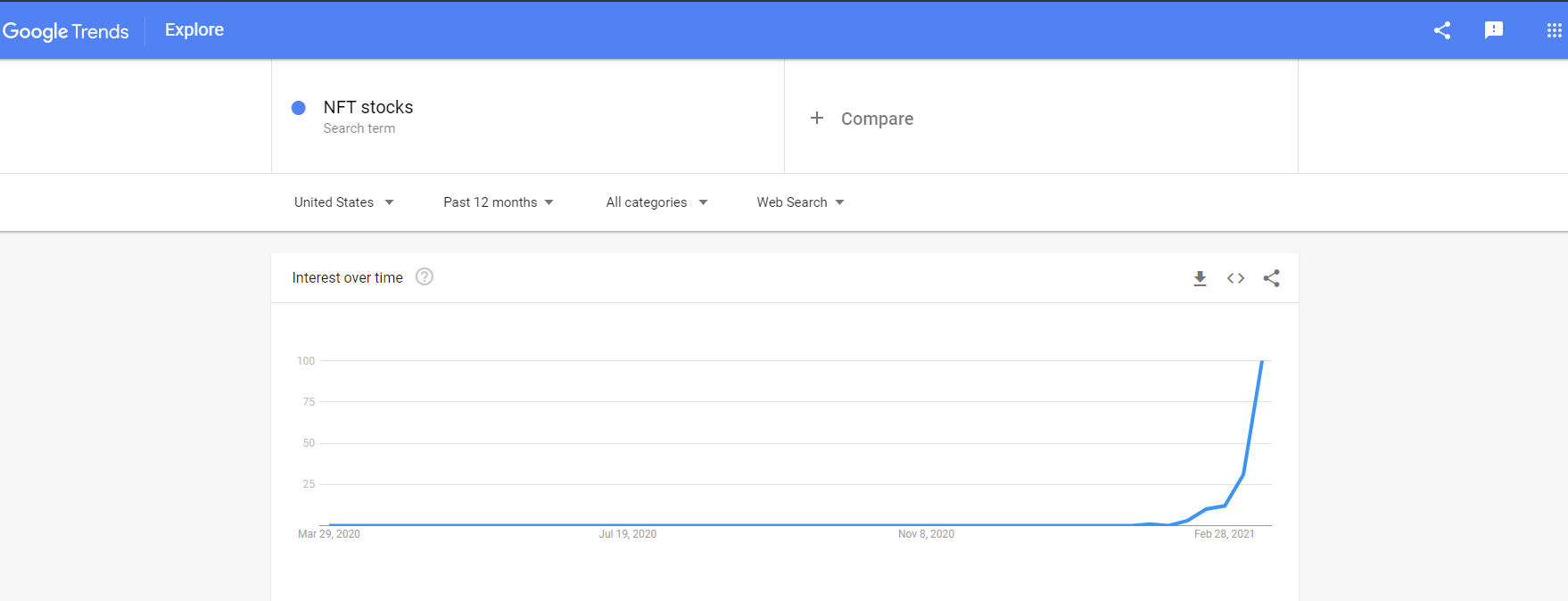

Data from Google Trends shows the surge in interest in NFTs and digital art, and there has been an explosion of search interest not only for NFTs, but also for NFT-related stocks in the past month.

The NFT craze began when celebrities like Elon Musk's partner, Claire Elise Boucher, who is known professionally as Grimes, made an entrance to the market. Grimes made $5.8 million in under 20 minutes selling NFTs in a February 28 auction.

Then the NFT boom slipped into fifth gear when the digital artist Beeple sold a painting titled "Everydays: The First 5000 Days" for a record $69 million in a Christie's auction.

And on Monday, Jack Dorsey's first-ever tweet sold for $2.9 million to Sina Estavi, CEO of the Blockchain company Bridge Oracle, adding fuel to roaring market.

The quick succession of big NFT sales has investors flocking to NFT-related stocks in the hopes of getting in on the ground level to cash in on a nascent crypto craze.

Given the sector's earnings and revenues, however, only time will tell if NFT stock investors will be rewarded with strong returns. Digital artists like Beeple claiming that many NFTs "will absolutely go to zero" doesn't inspire confidence for longer-term investors.